Counterfeit Hybrid Seeds: How They Destroy Farmer Trust, What Brands Can Do

For a farmer in Vidarbha preparing for the Kharif season, seed selection is the single most consequential decision of the year. It determines not just crop yield, but income, loan repayment, and family stability for the next twelve months. When that decision is unknowingly corrupted by a counterfeit product, the damage is not just agronomic — it is existential.

Counterfeit hybrid seeds are one of the most underreported and deeply damaging forms of agricultural fraud operating across India today. For seed manufacturers and agri-brands, the threat is not only to farmer welfare — it is a direct assault on brand equity, market share, and the trust that takes decades to build and one bad season to demolish.

This post examines how counterfeit seeds enter the supply chain, how they uniquely exploit the Rabi and Kharif purchase cycles, the scale of the problem in financial and human terms, and the concrete steps seed brands can take to eliminate fraud and rebuild farmer confidence.

The Scale of the Problem: What Seed Fraud Actually Costs

The seed industry in India is valued at over ₹35,000 crore and growing, which makes it an extraordinarily attractive target for counterfeiters. Unlike electronics or apparel, where a fake product's inferiority is often immediately visible, counterfeit seeds look identical to genuine ones. The fraud only reveals itself at harvest time — months after purchase, long after the dealer has moved on, and when it is far too late for the farmer to recover.

Estimated counterfeit penetration in unregulated seed markets

Across several high-value hybrid crop categories — particularly cotton, paddy, and vegetables — industry estimates suggest counterfeit or substandard seeds account for 25–35% of the unregulated retail market in vulnerable geographies.

Typical yield loss when counterfeit seed is sown at scale

Farmers planting counterfeit hybrid seeds frequently report germination failures, stunted growth, and complete crop loss. Yield shortfalls of 60–80% versus genuine seed performance are well-documented in affected districts.

Average per-acre financial loss to a deceived farmer

When input costs — seeds, fertiliser, irrigation, labour — are combined with the opportunity cost of the lost harvest, a single acre planted with counterfeit seed can result in a net loss exceeding ₹40,000 in a single season.

Time for brand trust to recover after a fraud outbreak

Field research and distributor surveys consistently show that brand loyalty collapses quickly after a counterfeit incident and takes multiple seasons — and significant marketing investment — to rebuild, even when the manufacturer was the victim.

Why Rabi and Kharif Cycles Create Perfect Fraud Windows

Seed fraud does not operate randomly — it is opportunistic and seasonally concentrated. Counterfeiters know exactly when farmers are buying, and they flood distribution channels in the weeks immediately before peak purchase periods. Understanding this timing is essential for seed brands designing their protection strategies.

The critical insight for seed manufacturers is that the fraud window precedes the purchase window by 4–8 weeks. Counterfeit product enters the distribution chain in the months before farmers actually buy, which means brand protection interventions need to operate upstream, at the distributor and dealer level, not at the point of sowing.

The kharif season is particularly high risk. Cotton and paddy hybrids command significant premiums, making them commercially attractive to counterfeit. In Maharashtra, Andhra Pradesh, and Telangana, surveys conducted post-harvest have revealed that in some districts, up to one in three farmers who reported crop failure had unknowingly purchased counterfeit or substandard seed from seemingly legitimate dealers.

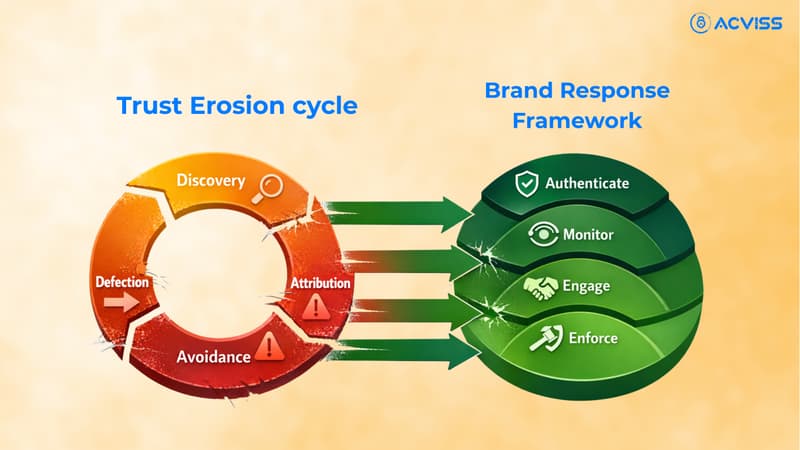

The Trust Erosion Cycle: How Farmer Confidence Collapses

The most dangerous long-term consequence of counterfeit seed fraud is not the single-season crop loss — it is the systematic destruction of brand trust that follows. Understanding how this erosion unfolds is critical for seed manufacturers who want to intervene before the damage becomes irreversible.

Stage 1 — Discovery (Post-Harvest Shock)

The farmer discovers crop failure or severe underperformance. Their first instinct is not necessarily to blame the seed — they question their own practices, the weather, and irrigation quality. This confusion phase is actually the most dangerous moment for brand reputation, because word-of-mouth begins before the root cause is established.

Stage 2 — Attribution (Dealer Blame Spreads)

As multiple farmers in the same village report similar failures, the conversation shifts to the common variable: the seed source. Even if the genuine brand's product performed perfectly elsewhere, the association with failure sticks. Dealers selling genuine products get blamed alongside those who sold counterfeits. The brand's name becomes synonymous with the failure event, regardless of fault.

Stage 3 — Avoidance (Brand Switching)

In the following planting season, affected farmers actively avoid the brand. More damaging, they advise neighbours and cooperative members to do the same. In tight-knit farming communities, a trust collapse can remove a brand from consideration across an entire tehsil within a single season — erasing years of agricultural extension work and relationship investment overnight.

Stage 4 — Long-Term Defection (Competitor Gain)

Farmers who have switched brands are significantly less likely to return, even after the counterfeit issue is resolved and corrective communication is deployed. The emotional and financial trauma of a crop failure creates a risk-aversion that keeps former loyalists away. Competitors who position against the affected brand see durable market share gains.

What Seed Manufacturers Must Do: A Four-Layer Response

The good news is that counterfeit seed fraud is not an intractable problem. Seed manufacturers who invest in the right combination of physical authentication, digital traceability, and channel accountability can significantly reduce fraud exposure and — critically — demonstrate to farmers that the brand is on their side.

Layer 1 — Authenticate at the Packet Level

Every seed packet entering the market must carry a tamper-evident, serialised authentication marker that the farmer can verify independently. QR codes linked to a cloud verification system allow farmers to scan a packet before purchase and receive instant confirmation — in their regional language — that the product is genuine. This single intervention puts verification power directly in the farmer's hands at the moment of purchase.

Unique QR codes with covert security features prevent duplication

Scan history creates a chain-of-custody trail from factory to field

Farmer-facing UI should be in the local language and require no app download

Packets that fail verification or return no scan record should raise immediate alerts

Layer 2 — Map and Monitor the Distribution Network

Most counterfeit seed enters the market through authorised-looking but unregistered or grey-market dealers. Seed brands must build visibility into every node of their distribution network — not just first-tier distributors, but secondary and tertiary retailers who are often invisible to brand headquarters.

Dealer onboarding with digital KYC linked to the brand's loyalty or trade program

Geo-tagged scan data reveals where the genuine product is being activated and where it isn't

Anomalies — such as a dealer location returning zero scans while neighbours show high activity — flag potential counterfeit displacement

Distributor audit trails make it possible to identify which nodes are sourcing grey-market products

Layer 3 — Engage Farmers Directly Through the Season

The information asymmetry that counterfeiters exploit is the gap between what the brand knows and what the farmer knows. Seed manufacturers who close this gap — through direct farmer communication, scan-based agronomy tips, and harvest-season follow-up — build a direct relationship that makes it far harder for counterfeit products to impersonate the brand successfully.

Post-scan engagement: confirm authenticity AND deliver agronomic advice for the specific variety

Seasonal reminder messages timed to Rabi and Kharif purchase windows, warning of fraud risk

Farmer grievance channels where suspected counterfeit can be reported directly to the manufacturer

Transparent communication when fraud outbreaks are detected in a region

Layer 4 — Create Consequences for Non-Compliant Dealers

Authentication and monitoring create visibility — but visibility only creates change when it is linked to accountability. Seed brands must create clear, enforced policies that reward dealers who operate within the authenticated channel and impose meaningful consequences on those who do not.

Loyalty programs tied exclusively to verified scan data — not just invoice-based claims

Dealer performance scores that include authentication compliance metrics

Conditional benefits: marketing support, co-op funds, and inventory priority linked to compliance

Clear termination policy for dealers found stocking counterfeit products

How Acviss Helps Seed Manufacturers Protect Farmer Trust

Acviss provides seed manufacturers with an end-to-end brand protection infrastructure specifically designed for the realities of agricultural distribution in India — multi-tier dealer networks, low digital literacy among farmers, and the time pressure of seasonal purchase windows.

Serialised QR codes with covert anti-copy features printed directly onto seed packets at source

Farmer-facing verification via missed call, SMS, or WhatsApp — no smartphone app required

Real-time scan analytics dashboard giving brand managers geolocation visibility of product activation

Dealer engagement and loyalty engine linked to verified scan compliance, not manual claims

Multilingual farmer communication in Marathi, Telugu, Hindi, Kannada, and other regional languages

Rabi and Kharif seasonal alert campaigns, warning farmers of known counterfeit activity in their district

The result is a seed brand that can truthfully tell a farmer — in their own language, before they buy — that the packet in their hand is genuine, that the company stands behind it, and that if anything goes wrong, there is a direct line back to the manufacturer.

That assurance is not a feature. In markets where counterfeit fraud has become normalised, it is a competitive differentiator that builds the kind of loyalty no trade scheme can manufacture.

Conclusion: Farmer Trust Is the Asset Counterfeiters Are Stealing

Every counterfeit seed packet that reaches a farmer is not just a product fraud — it is a theft of brand equity, a destruction of livelihoods, and a betrayal of the trust that seed manufacturers have spent generations cultivating. The Rabi and Kharif cycles mean the damage is compressed into a single devastating harvest, and the reputational fallout spreads at the speed of village conversation.

Seed brands that treat authentication as an operational afterthought will continue to be victimised. Those who build verification into the product, visibility into the channel, and direct engagement with the farmer will not only reduce fraud — they will create a trust infrastructure that counterfeiters simply cannot replicate.

The farmers planting your seeds this Kharif deserve to know that what is in the packet is what is on the label. Giving them that certainty is both the right thing to do and the smartest investment a seed brand can make. Ready to Protect Your Seed Brand?